100% Off and Free Udemy Coupons July 2025

Discover the ultimate guide to 100% off Udemy coupons for free access to top-tier online courses. Save money while mastering new skills with our regularly updated coupon codes and exclusive offers. Over 200 new Udemy coupons added in the last 24 hours! Whether you’re into coding, business, or creative arts, our curated list ensures you find the perfect course without spending a dime.

Top Udemy Coupons for Udemy Business

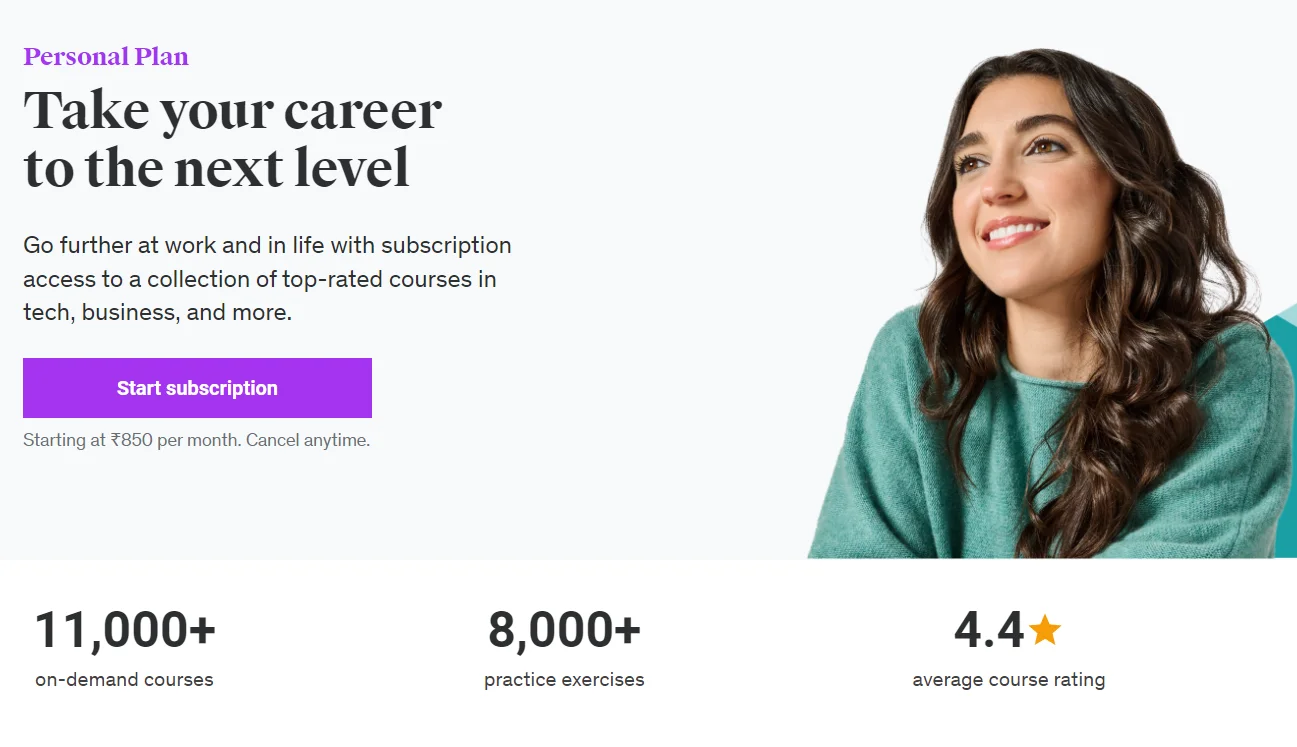

Get up to 90% off your Udemy courses and subscriptions. Try Udemy now for free with the 7-day trial. Expand your skills! Udemy Discount Code offers up to 90% off on select courses now!

Latest Update Free Udemy Coupons Today's

Access top udemy courses up to 90% off. Learn skills like Python, Web Dev. Exclusions apply. Learn Machine Learning, Data Science, R, Python, Django, & more. Exclusions apply. Highlights: Online Subscription Option Available, Offering A Range Of Categories.